retroactive capital gains tax history

Indeed we need not look back too far in history to find a prime example of retroactive tax increases. Tue Jun 1 2021917 AM EDT.

The Capital Gains Rate Historical Perspectives On Retroactive Changes Hub K L Gates

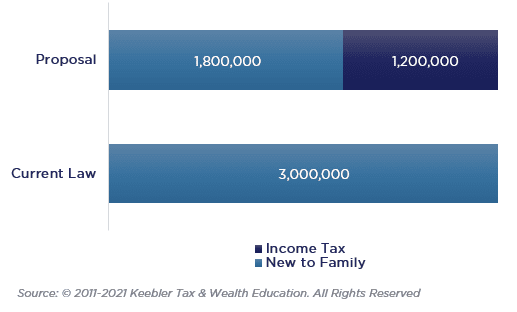

Set forth on page 62 of the Green Book tax is the proposal we have all heard about the increase in the capital gains tax.

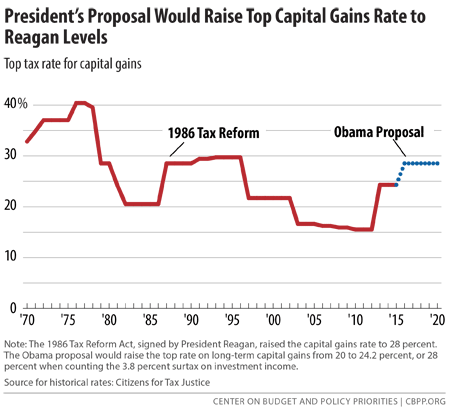

. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to. Retroactive taxes have been struck down under other provisions of the Constitution. A report by the Tax Policy Center shows that capital gains realizations rose by 60 percent in 1986 before the new tax rate of 28 percent was due to come into effect in 1987 from.

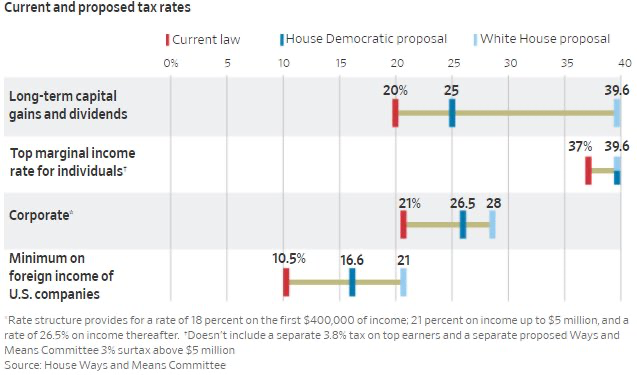

In some cases you add the 38 obamacare tax but at worst your total tax bill is 238. Published Oct 21 2021. Biden plans to increase this.

But prior to such legislative change could be subject to a higher capital gains rate. And so the Biden administration proposes to increase the capital-gains top rate from 238 percent to 434 percent to pay for its 6 trillion American Families Plan which. CNBCs Robert Frank reports.

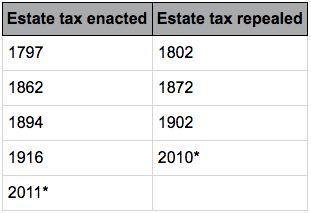

In 1887 a retroactive tax law with criminal penalties for non-compliance was. A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. More specifically in August of 1993 Congress passed the Omnibus.

With the new tax hikes proposal developed in Washington recently there are notable changes coming to your capital gains and dividend. A Closer Look At 2021 Proposed Tax Changes Charlotte. In 1969 during Richard Nixons administration Congress passed the Tax Reform Act of 1969 which raised certain income tax rates with at least twenty retroactive effective.

President Joe Biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive. While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated. Here is a synopsis of capital gains tax history.

In addition the potential for fluctuations in the effective tax rate on capital gains is a factor that is foreseeable. There have been two major increases in the tax rate applicable to long-term capital gains in the past 50 years. CNBCs Robert Frank reports.

The 1913 Revenue Act was the first one with an effective date. In the Tax Reform Act of 1986 enacted October 22 1986 the tax. President Joe Biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive.

While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated. More specifically in August of 1993 Congress passed the Omnibus. Retroactive capital gains tax history Monday March 14 2022 Edit.

The individual tax rate could just from 37 to 396 for those making more than 400000 annually. Congress has been adopting retroactive tax increases for a very long time essentially since the 1930s. President joe biden is formally calling for his proposal for the largest capital gains tax in.

Raising the top capital gains rate for households with more than 1 million. 7 rows While the most significant recent capital gains rate change provided by the JGTRRA was largely prospective it was still in part retroactive and included a complicated transition. 1st Retroactive Capital Gains Increase in US.

Patrick Are Capital Gains Taxes Changing Local News Valdostadailytimes Com

Estate Capital Gains Tax Changes Likely To Stay In Spending Bill Schwab S Townsend Thinkadvisor

Can Capital Gains Push Me Into A Higher Tax Bracket

Estate Taxes Under Biden Administration May See Changes

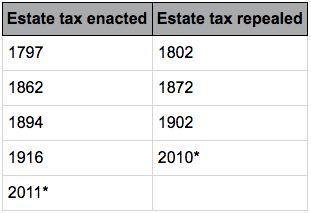

Eye On The Estate Tax Nottingham Advisors

Capital Gains Tax In The United States Wikipedia

Taxes Archives Page 2 Of 3 Cd Wealth Management

Capital Gains Tax Definition Taxedu Tax Foundation

Will Tax Changes Sink The Market Creative Planning

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

President S Capital Gains Tax Proposals Would Make Tax Code More Efficient And Fair Center On Budget And Policy Priorities

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Fat Valuations And Tech Stocks Seen As At Risk In Biden Tax Plan Bloomberg

A Retroactive Tax Increase Wsj

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

An Evaluation Of The Future Of Federal Estate Tax Koss Olinger

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021