capital gains tax proposal washington state

If we accept the states argument that its an excise tax then its probably an unconstitutional one because it fails to meet the nexus requirements established in cases like Complete Auto Transit v. Retirement accounts homes farms and forestry are exempt.

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

The bill would levy a 7 tax on the capital gains from sales of assets like stocks and bonds that exceed 250000.

. Many forms of assets are also. Powerpoint presentation on the proposed Income Tax on Capital Gains from Jason Mercier SB 5096 would impose a 9 income tax on capital gains in Washington state A warning from France on wealth taxes New state tax proposals examined by Jason Mercie r Per-Capita Inflation adjusted state spending has more than doubled since 1970s. For example if your annual gains are 249999 no additional tax is incurred.

Jay Inslee signed a critical piece of tax reform legislation. Inslee proposes a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

Revenue impact This proposal impacts approximately 58000 taxpayers and will impact the state general fund in the following ways. It taxes out-of-state earnings and out-of-state activity. Once again Inslee wants the state to enact a nine percent tax on capital gains earnings above 25000 for an individual or 50000 for a couple with a goal of bringing in 11 billion in 2023 and 24 billion in the 2023-25 budget cycle.

The new tax would affect an estimated 48000 taxpayers. Among the most controversial elements of the proposal is a proposal that would make Washington the only state to tax capital gains but not impose a general income tax. The measure would impose a 7 capital gains tax on individuals and couples who make in excess of 250000 on sales of stocks and bonds.

A capital gains tax collected when the sale of property is made and a profit is realized is conceptually the same as the real estate excise tax imposed under Chapter 8245 RCW a tax which was upheld as an excise tax by the Washington State Supreme Court soon after its enactment. Senate Bill 5096 sponsored by Sen. Washingtons capital gains tax is designed as a direct tax not an indirect one.

The new law will take effect January 1 2022. Washington Enacts New Capital Gains Tax for 2022 and Beyond By Dirk Giseburt Michael E. Critics of the plan have already documented how capital gains taxes substantially increase tax volatility but to many it may not be obvious just how volatile capital gains can be.

The state would apply a 79 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. The State has appealed the ruling to the Washington Supreme Court.

Gentile and Dana M. Retirement accounts all property sales farms and forestry. Senate Bill 5096 levies a 7 tax on Washington residents annual long-term capital gains exceeding 250000.

5096 which was signed by Governor Inslee on May 4 2021. This tax only applies to individuals. Reid 051721 Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

Under the measure Washington residents would be taxed on capital gains in excess of 250000 raising an estimated 527 million in FY 2023 rising to 734 million by FY 2031 for a 10-year projection of 574 billion in additional tax revenue. If theyre 250050 you incur a 7 state tax on that extra 50. Barring any legal challenges the new tax kicks in beginning January 1 2022.

Current law No capital gains tax currently exists in Washington at the state or local level. FOR IMMEDIATE RELEASE. The new tax would affect an estimated 42000 taxpayers about 15 percent of households in the first year.

OLYMPIA Wash A proposed tax on capital gains which are profits made on investments would generate more than a billion dollars for state services and help the state deal with the COVID-19. Sales of anything under 250000 are exempt. Tremper 40 Wn2d 405 243 P2d 627 1952.

This proposal is effective January 1 2022 with the first capital gains tax return due April 15 2023. June Robinson D-Everett enacts a capital gains excise tax to fund the expansion and affordability of child care early learning and the states paramount duty to provide an education for the. 2 days agoThe group also raised concerns about the measure failing to define capital gains failing to state that it could delay eviction cases and.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Inslees office estimates that about 2 percent of Washington households would pay the tax in the first year. OLYMPIA Earlier today Gov.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Jay Inslee on Thursday unveiled a 2021-23 operating budget proposal that includes 576 billion in spending for state operations such as schools prisons and social services. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Biden S Build Back Better Hits Blue States Harder

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Income Tax Increases In The President S American Families Plan Itep

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

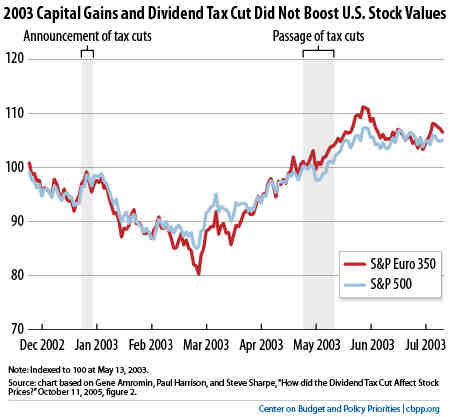

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

New York California Capital Gains Tax Rates Would Top 50 Percent In Biden Proposal

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire