when will i get my minnesota unemployment tax refund

Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point. If you owe MN income taxes you will either have to submit a MN tax return or extension by the April 18 2022 tax deadline in order to avoid late filing penalties.

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

However many people have experienced refund delays due to a number of reasons.

. State Income Tax Range. State Taxes on Unemployment Benefits. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable.

Yet despite months of lead time no one can say when the checks will get cut. Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. Tim Walz called for compromise in negotiations to replenish the states unemployment insurance trust fund and to pay frontline worker bonuses during his fourth State of the State.

When will I get my unemployment tax refund. View step-by-step instructions for accessing your. Another way is to check your tax transcript if you have an online account with the IRS.

More complicated ones took longer to process. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. We will start to mail out 1099-Gs in mid-January and will complete all mailings by January 31 2022.

535 on less than 27230 of taxable income for single filers and on less than 39810. Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. 2 days agoMinnesota Gov.

Your refund will most likely display as IRS TREAS 310 TAX REF if you have a direct deposit account. Minnesota Department of Revenue set to begin processing Unemployment Insurance and Paycheck Protection Program refunds. As of January 27 2022 we have.

The first phase included the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return. Sadly you cant track the cash in the way you can track other tax refunds.

FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. Thousands of taxpayers may still be waiting for a. Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes.

It is too late to change your address for the 1099-G mailing but you can access your 1099-G online. In addition to the refund on unemployment benefits people are waiting for their regular IRS tax refunds. If you dont the IRS will mail your return as a physical check to the address on file.

If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return. The jobless tax refund average is 1686 according to the IRS. When will I get the refund.

When will I get my jobless tax refund. Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. Tax refunds on pandemic payroll unemployment benefits still in limbo Minnesota owes half a million taxpayers a refund.

Tax refund time frames will vary. State Income Tax Range. The IRS plans to send another tranche by the end of the year.

When Will I Get The Refund. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020 You do not need to take any action if you file for unemployment and qualify for the adjustmentIf the IRS has your banking information on file youll receive. The IRS normally releases tax refunds about 21 days after you file the returns.

Within 30 days of correcting the IRS will send you a notification detailing the changes. The department expects these returns and refunds to be completed by the end of the year in time for New Years Eve. Meanwhile the manual processing which involves returns with more complicated tax circumstances began the week of September 13.

The unemployment exemption is being implemented in certain states but not all for state income. The first phase included the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits. The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds.

Federal and MN State unemployment tax refund. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G.

21 days or more since you e-filed. The agency had sent more than 117 million refunds worth 144 billion as of Nov. The state of Minnesota has determined that weve got 540000 tax returns that are affected by PPP unemployment and some other things that have been passed along the way and we are going to fix.

About 500000 Minnesotans are in line to get money back from the tax break on the first 10200 of 2020 unemployment benefits. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. Minnesota taxes unemployment benefits.

Surprise Checks Of 584 Going Out To More Than 500 000 Households Before New Year S Eve Do You Qualify

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Unemployment Income And State Tax Returns Uce Refund

Where S My Refund Minnesota H R Block

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

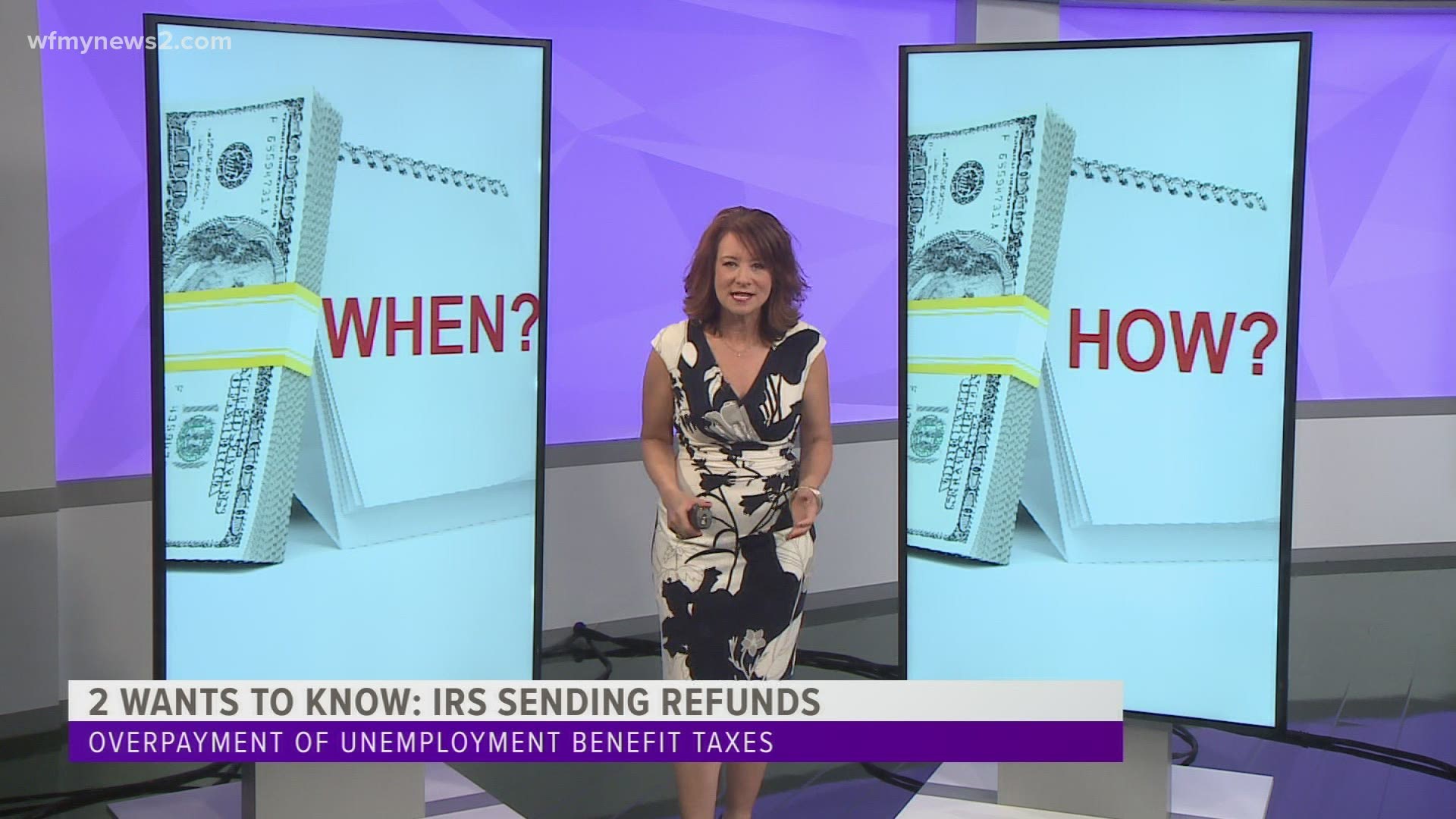

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Kare11 Com

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

When Will Irs Send Unemployment Tax Refunds Kare11 Com

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

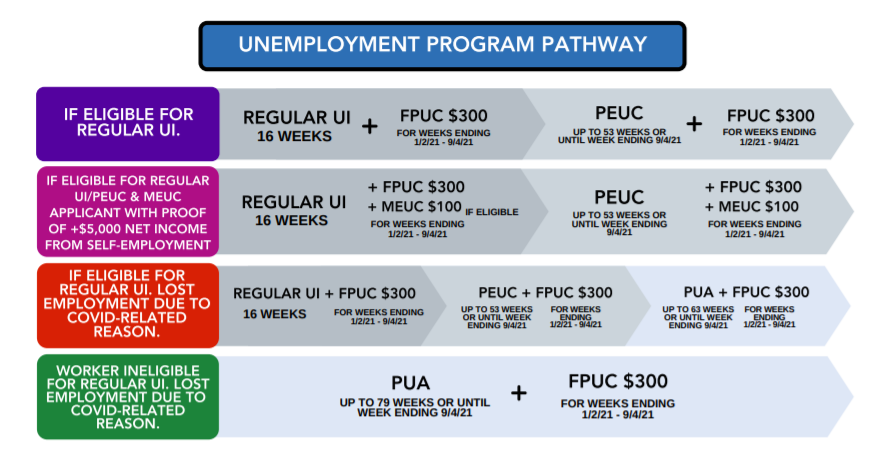

Minnesota Unemployment Relief For Covid 19

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

When Should Minnesotans Expect Tax Refunds Passed In The State Budget Star Tribune

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com